The twentieth anniversary of this “Bear’s Lair” column passed in late October. During that period, the stock market has risen, but pretty much every other indicator of U.S. economic health has declined. Actuarially at age 70, I can expect to be writing this column for another 14 years and 3 months (though the column’s coherence may be limited in the last few years of that). Whether this column will cover the final “Bearmageddon” collapse of our economic system is thus uncertain – it will be a damned near-run thing, as the Duke of Wellington said of Waterloo.

The twentieth anniversary of this “Bear’s Lair” column passed in late October. During that period, the stock market has risen, but pretty much every other indicator of U.S. economic health has declined. Actuarially at age 70, I can expect to be writing this column for another 14 years and 3 months (though the column’s coherence may be limited in the last few years of that). Whether this column will cover the final “Bearmageddon” collapse of our economic system is thus uncertain – it will be a damned near-run thing, as the Duke of Wellington said of Waterloo.

For the stock market, the last twenty years have been wonderful. The Standard and Poor’s 500 index was still close to its all-time high in December 2000, at 1,335 (the electoral uncertainty of that year had dinged it, but not all that badly – it was around 10% below its peak earlier in the year). However, as I write today it is at 3,703, a rise of 177% over 20 years, or 5.3% per annum. Add to that another 2.5% or so in dividend yield, and you have a return that is well ahead of average consumer price inflation (49.3% or 2.0% per annum) or even the rise in GDP over the period (102.7% or 3.6% per annum). In other words, stocks over the twenty years have been an excellent investment, albeit becoming significantly more expensive from an already pricey base. For other economic indicators, however, the picture is very different.

For example, productivity growth is the most important component of long-term increase in living standards – without one, one cannot have the other. From 1996 to 2000, productivity growth averaged a healthy 2.8% annually, as fast as in the halcyon post-war period of 1948-73, and much faster than in the intervening two decades. In 2015-19, on the other hand, productivity growth averaged a mere 1.2%, less than half as rapid. At that, it was benefiting from a modest acceleration under President Donald Trump; over the six years 2011-16, it averaged only 0.7% per annum. Clearly, the U.S. economic machine is in an advanced state of decay; if you think productivity growth will improve under the regulation-crazy administration of President–elect Joe Biden, I can get you a deal on the Brooklyn Bridge.

The behavior of the Federal budget over the period is in many ways even more alarming. In 2000, it was solidly in surplus, by about $33 billion, with government spending (the key variable) about 31% of GDP. In 2019, even before the advent of Covid-19, the budget deficit was $1.43 trillion, 7% of GDP, and expenditure was 34% of GDP. Receipts over the period declined from 31% of GDP to 27.4% of GDP, so the yawning deficit is the result about equally of poor income discipline and excessive expenditure laxity. In any case, the deficit has widened to 15% of GDP in 2020 and, from the look of it, 2021, while government debt has soared from 5% of GDP to over 136% of GDP in 2020.

The excessive Federal debt is matched by excessive debt throughout the U.S. economy. Mortgage debt has risen faster than GDP, as has consumer debt, while student loans, almost negligible in 2000, are now a $1.6 trillion and a growing economic problem. Pensions appeared to be very well funded indeed in 2000, but even the fine returns on stocks and, through capital appreciation, on long-term bonds, have left holes in pension schemes all over the system, especially in the public sector. (The private sector has sloughed off the risk of inadequate investment returns onto its employees. The Baby Boomers are currently in the early years of their retirements, under the mistaken impression that their meager savings will prove sufficient; in the world of low returns that we are now entering, they won’t. The eighty-year-old Boomers of 2030 will be drinking very thin gruel and will be an additional burden on the welfare and medical systems.)

The corporate sector’s behavior has also degenerated sharply over the last twenty years. The ever-rising stock market has caused corporate management to play silly accounting games to justify foolish, damaging levels of share repurchases. It has also caused an ever more short-term focus for capital investment and the like, focusing management on quick-hit meretricious “deals” rather than the long-term health of the business. Together with artificially low interest rates, which have distorted capital allocation, this tendency is responsible for the shocking deterioration in U.S. productivity growth over the last twenty years.

Now corporate management is about to get even worse, as the Business Roundtable has announced it no longer needs to create shareholder value, but only pursue the social and environmental goals that are fashionable at the left-wing cocktail parties to which top management yearns to be invited. Capitalism ruled by social goals is not capitalism, it is yet another loathsome form of hopelessly economically inefficient socialism, and the U.S. economy’s performance will shortly reflect this fact.

When peering forward 14 years, we need to make some political assumptions. We should make an “average” assumption about electoral outcomes, so the U.S. will be run by governments somewhere on the mediocre, utterly uninspiring spectrum between Marco Rubio and Joe Biden, tottering gently down the slope away from capitalism, without either the sharp turn towards redemption of electing Ted Cruz or the sharp turn towards rapid perdition of electing Alexandria Ocasio-Cortez.

We should also assume that no other superpower will arise to challenge U.S. economic complacency. Russia is too small and weak, while China, though apparently strong, in reality is suffering from a tottering tower of debt and a shaky underpinning of politically-motivated investment that will probably cause it to go backwards rather than forwards over this period. Only India may rise towards parity, but India is both sufficiently benign and sufficiently far from parity currently not to become a threat within this period. As for the EU, it would like to threaten U.S. hegemony, but its own appalling bureaucratic leadership slows its growth to the immeasurable and makes it always a few paces further down the path to perdition than the U.S. itself.

With the above political and geopolitical environment, the path ahead can be inferred simply by linear extrapolation. Productivity growth, reduced from 2.8% to 0.7% over the period 2000-16, will revert to that trajectory, and arithmetically be negative 0.8% per annum by 2034. Even without taking account of the aging and de-skilling of the U.S. workforce (you will get one or the other, possibly both depending on the immigration level and the further decay of the college system into woke-hood) GDP per capita will thus stop growing in 2027 and begin to decline thereafter.

As for the Federal budget deficit, assume that the two years 2020 and 2021 are anomalous, and that no further pandemics will arise to devastate the economy. In that case, the deficit will reduce to around $1.8 trillion per annum from the year to September 2023, about 8% of that year’s GDP. However, the Federal debt in September 2022 will be around 150% of GDP, so even taking a simplistic approach, by 2034, Federal debt would be 246% of GDP, even assuming GDP was still increasing, which it will not be. With the decay in productivity growth from 2020 on, debt will increase faster as a percentage of GDP, reaching around 2030 the figure of 250% of GDP above which debt burdens have in the past become impossible to manage.

With Federal debt becoming un-manageable about 2030, economic growth stopping around 2027, Social Security going bankrupt around 2033 or a little earlier and Medicare going bankrupt in 2026, there is a confluence of disaster around the end of the decade. In 2030, all the U.S. social security and Medicare programs will bankrupt or nearly so, the economy will be showing negative growth and negative productivity growth, public debt will be soaring above the 250% of GDP level at which default becomes inevitable. In such an environment, there must inevitably be a crisis in which investors, most of them foreign, refuse to finance the U.S. government. That will cause a stock market crash and a massive spike in interest rates for both the government and all other U.S. borrowers. The result will be a catastrophic decline in U.S. living standards, at least of the order of 50%.

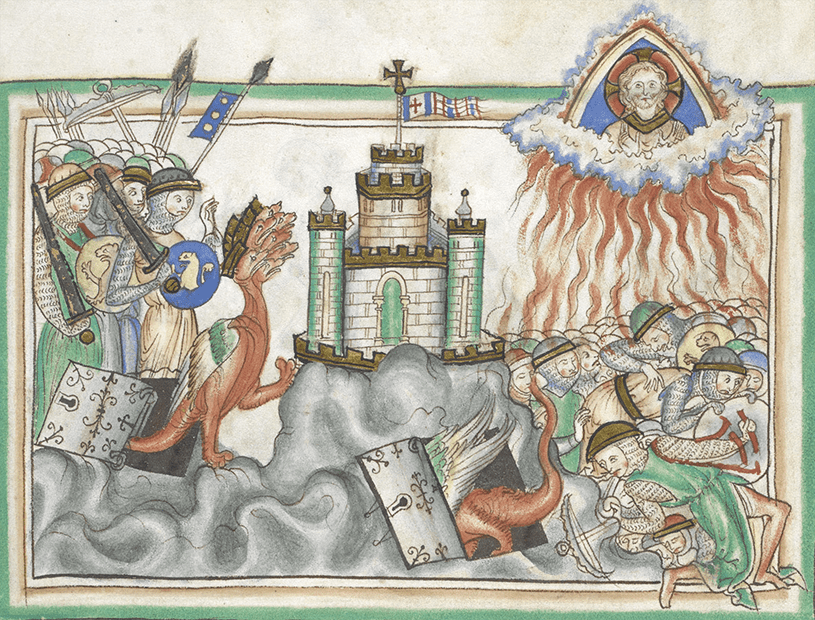

The End Times of Bearmageddon will thus probably hit the United States around 2030 – we have after all, had a foretaste of the Four Horsemen (War, Famine, Pestilence and Death) this year. I should still be around to witness it; I look forward to reporting on it in this column, if the lights have not gone out.

-0-

(The Bear’s Lair is a weekly column that is intended to appear each Monday, an appropriately gloomy day of the week. Its rationale is that the proportion of “sell” recommendations put out by Wall Street houses remains far below that of “buy” recommendations. Accordingly, investors have an excess of positive information and very little negative information. The column thus takes the ursine view of life and the market, in the hope that it may be usefully different from what investors see elsewhere.)